The Progressive Tax soon to be levied upon future generations of Illinoisans is the criminal enterprise won via class warfare.

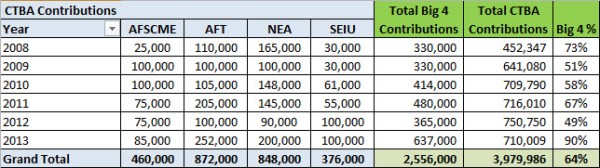

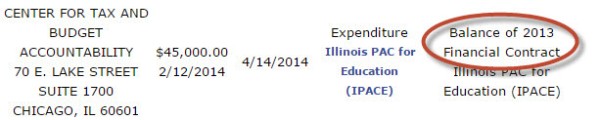

Full Progressive Tax Credit should go to Ralph Martire of River Forest, IL and the Center for Tax and Budget Accountability. No man has worked harder, longer, or more patiently than Dawn Clark Netsch's budget wizard. Illinois needs a flat tax, but that makes too much sense - this is Illinois!

Ralph Martire's mantra is, and has been, " Illinois doesn't have tax problem; it has a revenue problem" -meaning: people still have a few dollars that they earned and the oligarchs can not allow that.

Karl Marx could not be happier! JB Pritzker is Governor! Infanticide Rules! Weed is Legal! Illinois Middle Class is going Soylent Green with the Martire Progressive Tax!

The Illinois Animal Farm demands the death of the middle class, all the while pretending to "work" for the middle class. The Illinois Middle Class has been commiting fiscal suicide on the installment plan for decades ( voting clowns and grifters like Jim Edgar, bruce Rauner, Pat Quinn and Blago) and now with the election of JB " Legal Weed" Pritzker the class that pays for government will go all Soylent Green.

Soylent Green was a fictional story of a dystopia, not unlike Illinois, where the elderly, the weak the infirm are gulled into believing what the government says and "disgusted with . . . degraded life in a degraded world that . . . decide to "return to the home of the God" and seeks assisted suicide at a government clinic."

The corpses are recycled ( as they should) and turned into a food product - Yummy Soylent Green. "Soylent Green is people!" It sure is!

Illinois is People! Pat Quinn, the most oafish of all our Governors and a dedicated Leftist, shouted about Illinois' "Everyday People!" while he furthered government assisted murder via Personal PAC, re-defined marriage and drove Ralph Martire to newer levels of power.

Ralph Martire is the Father of Illinois Taxes and JB Pritzker's guru,

Ralph Martire's neighbor and co-religionist, " Il State Sen. Don Harmon (D-Oak Park) is carrying an amendment to adopt a “graduated” income tax structure in the Senate. Harmon said he expects the Legislature to begin its role in the process soon, and he expects a fight. " Not much of a one, give the fact the terminally fetal Illinois GOP of Jim Durkin will mount no opposition and Democrats hold a super-majority in the Illinois Legislature, which they are also using to make Illinois the Abortion Industry's # 1 Abattoir!

"Soylent Green is people!"

Hey, why not eat the aborted, Kids? Get Terry Cosgrove on that One! Revenue Babies! Sorry, I digress.

Don Harmon states in today's Sun Times, the hardest working propaganda organ outside of Moscow,

“I’m hoping to start talking about this in earnest when we’re back in Springfield next week,When an Illinois oligarch calls a tax "Fair" expect a vigorous and thorough screwing.

” Harmon said. “This is certainly going to require a full-fledged campaign to convince voters to ratify the amendment. I expect we’ll be joined on both sides of the debate with vigor and resources.”

At this point, however, the constitutional amendment would give the Legislature the ability to change only the income tax structure — it wouldn’t set the actual income tax rate.

No specific rate structure has been proposed, and Pritzker spokeswoman Jordan Abudayyeh did not give a timeline as to when it could be expected.

“As the discussion on the amendment moves forward, the rate structure will be negotiated with the General Assembly before a vote takes place so the public has a full and transparent understanding of the way forward,” she said.

Despite a lack of details, politicians and interest groups are rushing to define the measure in the minds of the voters who will have the ultimate say as to whether it becomes law.

Some supporters, including Pritzker, Harmon and Democratic House Speaker Michael Madigan of Chicago, are calling the amendment a “fair tax” proposal.

Don Harmon will ease through the progressive tax with all of the grease, unction and K-Y jelly that Rep. Greg Harris slipped in the re-definition of marriage and the opportunity to say bad things about Chick fil Ay. The late sainted, Francis Cardinal George warned Illinois that same-sex marriage legislation was "acting against the common good of society." It was, He also stated "The state has no power to create something that nature itself tells us is impossible." Euclid died in Illinois, as did how marriage is defined, but the heart wants what the loins urge.

Same thing with taxes! Illinois is a disaster developing into a catastrophe. Soylent Green is People!

Jussie Smollett and Ralph Martire carry compelling narratives accepted by oligarchs.

That is the end of Don Harmon's dialog, folks.

Crack open them piggy banks.

Soylent Green is People! Well, Bon apetite. Ralph!