“What is our basic problem? I think it’s been a lack of political will for generations to deal with tax policy honestly. Tax is one of two, three-letter words ending in ‘X’ in the English language that really gets people excited. And generally, not in a good way. So, most elected officials want to avoid dealing with tax policy. Our chosen method for avoiding dealing with tax policy in Illinois has been, and everyone knows this, is to underfund what the state owed to its five pension systems and divert the revenue that should have gone to normal costs to instead fund current services.” Ralph ("Illinois faces a revenue problem, not a pension problem.") Martire Illinois Director of Lotus Eaters

For nine days I was driven by fierce winds over the teeming sea: but on the tenth we set foot on the shores of the Lotus-eaters, who eat its flowery food. On land we drew water, and my friends ate by the ships. Once we had tasted food and drink, I sent some of the men inland to discover what kind of human beings lived there: selecting two and sending a third as herald. They left at once and came upon the Lotus-eaters, who had no thought of killing my comrades, but gave them lotus to eat. Those who ate the honey-sweet lotus fruit no longer wished to bring back word to us, or sail for home. They wanted to stay with the Lotus-eaters, eating the lotus, forgetting all thoughts of return. I dragged those men back to the shore myself by force, while they wept, and bound them tight in the hollow ships, pushing them under the benches. Then I ordered my men to embark quickly on the fast craft, fearing that others would eat the lotus and forget their homes. They boarded swiftly and took their place on the benches then sitting in their rows struck the grey water with their oars.’ Odyssey

People who use the phrase "Help Working Families" could care less about families, much less the work that they do. People who use the phrase "Help Working Families" want more, much more of the few dollars earned by working stiffs for their families.

Meet Ralph Martire! Way back when . . . when Jim Edgar was Governor . . .Dawn Clark Netsch was the Illinois Comptroller and used that office to rail against Illinois Tax policies. Old Abner Mikva schooled Dawn Clark real good. Get the middle class and plutocrats to pay the checks.

In 1992 Democrats and Republicans even got together to draft a statewide referendum asking voters to fund at least 51 percent of educational costs through the income tax. But a few days before the election the sitting governor, Jim Edgar, a Republican, announced that he would vote against the measure on the grounds that the state couldn't afford to commit so much money to education. The referendum still got 58 percent of the vote, but it needed 60 percent to pass.And Illinois drifted off into its long dope-induced snooze. One might argue that this was the advent of Hopium, as John Kass so accurately termed the eight year bender of the Obama years. It feels good to drift away and just gnaw on the Lotus leaves. No problem so big that one can not run the hell away from it!

In 1994 Democratic gubernatorial candidate Dawn Clark Netsch revived the issue, calling for a swap. Edgar mocked her as a tax-and-spend liberal and scoffed at the notion that the state needed a great new source of money. He won reelection with almost 60 percent of the vote.

A few weeks after his victory Edgar bowed to fiscal reality and changed his tune. Citing a pending budget crisis, he appointed a blue-ribbon committee to study the idea of a tax swap. The committee produced a plan similar to Netsch's, and with Edgar's backing it made its way through the house of representatives. It died in the state senate, killed by another Republican, senate president James "Pate" Philip. One longtime observer says Philip acted more out of political spite than ideology: "Pate was mad at Edgar. He basically said, 'I'd told everyone you weren't going to do this, and you did it--so screw you!' Nothing's happened on this front since.

Folks like Ralph Martire offer the Lotus, but we gobble it up and feel good about it.

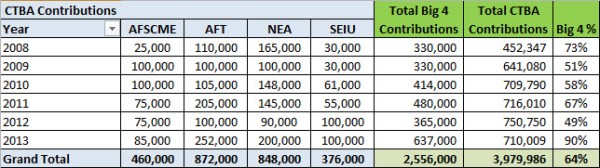

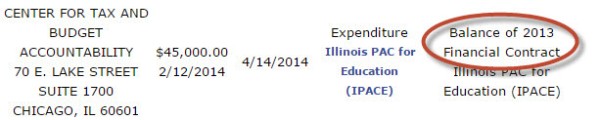

Ralph is the boss of the ' non-partisan' Center for Tax and Budget Accountability (CTBA). CBTA is a shell game of pie-chart pirates from public sector funded organizations, unions, and the Woods Fund which provides the math and the bullshit to argue for tax-increases on working families.

Note - every huge contributor to Ralph Martire Enterprises has been handsomely rewarded with an Illinois Pension - which is as valuable as Confederate Money. The Woods Fund which helped give us Barack Obama and a nice sinecure for Bill Ayers, made up the balance.

Ralph worked with Dawn Clark Netsch to end Illinois' 'regressive tax' policies. Tax more and spend more is the mantra. Give to every advocacy and reap re-election! Glut public pensions and tax the rich.

It worked and between oily Jim Edgar and sand-paper smooth Bruce Rauner, every Governor and every General Assembly have kicked cans down deteriorating roads, burned inadequate bridges and flood more debt.

All the while the voters of Illinois have done a solid for the Guvs, the Speaker, the legislative leadership and both Houses stocked with feather-weight intellects and moral midgets by returning the clowns to the Big Top every voting cycle - the clowns merely exit their tiny cars, disappear for a while and return to the Big Top.

People who had means, beat it out of Illinois.

Illinois is drowzey, sleepy and really dopey.

It is not the Land of Lincoln; it is the Land of the Lotus Eaters.

Lotus leaves provided by Marxist economists, Ralph Martire, the Illinois Media, Bad Math, the Paul Simon Institute and every boob you send to Springfield - in both parties.

Illinois needs an Odysseus to grab Illinois by the short and curlies and drag it screaming and kicking back to its senses.

Good luck with that.

No comments:

Post a Comment